Transforming The B2B Customer Experience: AI's Role In Streamlining Document Processing

Dharmarajan Sankara Subrahmanian

Forbes Councils Member

Forbes Technology Council

Oct 18, 2023

By Dharmarajan Sankara Subrahmanian, Founder & CEO, Impactsure Technologies.

In an era of data, e-commerce and digital payments, B2C and B2B2C transactions have witnessed a transformative surge in customer experiences. Whether booking a cab, ordering a pizza or making a seamless payment through UPI, simplicity and convenience reign supreme.

However, the B2B (and B2B2B) sectors must catch up in delivering captivating customer experiences. Historically, these sectors have been slow to embrace technological innovations.

A significant reason for this gap lies in transactions. B2C transactions, like hailing a ride or ordering food, involve minimal paperwork or compliance requirements. On the other hand, B2B transactions revolve around complex business processes, necessitating extensive documentation.

Industries like manufacturing, shipping, import-export and B2B banking grapple with a large amount of paperwork related to logistics, transportation, insurance, invoicing, customs and payments. The process can take hours to weeks, depending on geographical factors and regulatory complexities.

The crux of the issue lies in the tedious and time-consuming nature of compliance-driven document processing, which hampers instant gratification for customers. Let's delve into trade documentation, which includes manual form-filling, error-prone data entry and precise tracking of shipped goods. Remarkably, even global logistics giants rely on antiquated manual processes, from my experience.

A Look At AI-Powered Intelligent Document Processing

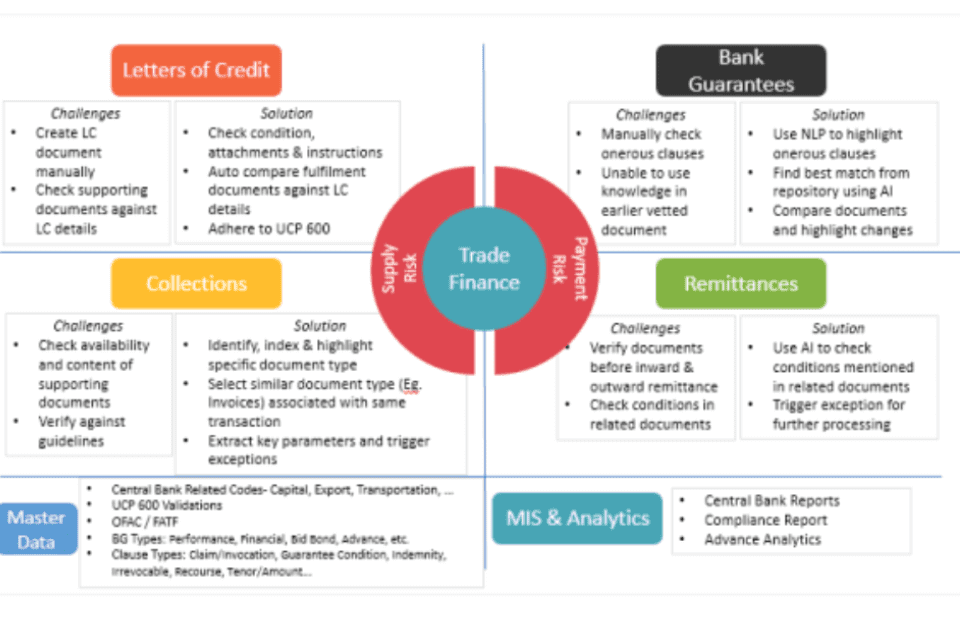

Bank guarantees and letters of credit (LC), remittances, collections and other crucial elements of commercial banking involve submitting numerous documents that banks must scrutinize for compliance. This manual review process is both time-consuming and susceptible to errors and fraud.

These protracted delays and monotonous processes can compromise the customer experience in the B2B space. In light of this, many companies are turning to artificial intelligence to reduce document processing times from days to minutes while offering hyper-personalization tailored to specific industry sectors.

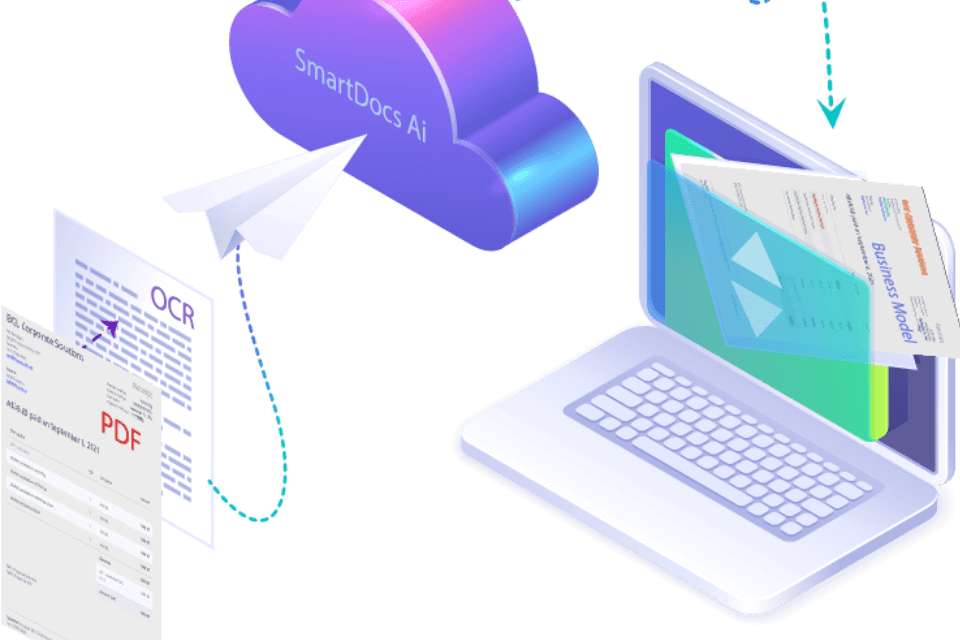

Solutions based on AI, machine learning (ML), neural networks and natural language processing (NLP) work within secure environments to scan, process, classify and extract unstructured and semi-structured data from various file formats including notes.

AI-powered document processing can understand clauses, identify critical fields and integrate with existing workflows. Eliminating manual data processing can help save time, minimize errors, enhance filing accuracy and ensure compliance.

Hyper-Personalization With IDP: Elevating B2B Customer Experiences

In today's data-driven world, AI-driven intelligent document processing (IDP) is improving B2B customer experiences across sectors. Here are some real-world areas we're seeing an impact.

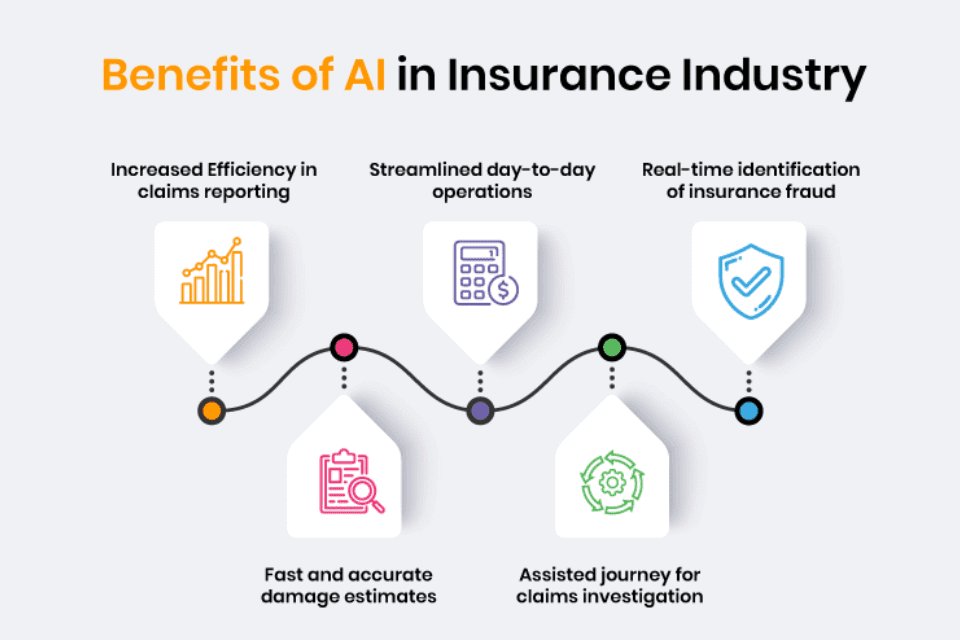

- Corporate Banking: Utilizing AI-driven document processing can speed up the handling of vital corporate banking paperwork, including bank guarantees, letters of credit, remittances, collections, mortgages, current account documents, loan origination documents and more. This technology expedites "know your customer" (KYC) procedures for tailored onboarding and assesses financial information to enhance customized loan offerings, ultimately improving customer satisfaction.

- Global Trade: AI-powered document processing can streamline international trade documentation, meet country-specific requirements and provide real-time shipment tracking for proactive supply chain management.

- Insurance: Claims can be automated for faster settlements and paired with personalized policy recommendations, taking individual profiles into account to enhance trust.

- Corporations: AI-powered document processing automates invoice processing, simplifies import/export documentation and streamlines legal contract management, reducing hassles and making data retrieval easier.

Delivering Delightful Customer Experiences

The notion that "charity begins at home" holds true for crafting an engaging customer experience with AI-powered document processing as well. To begin their transformative voyage, B2B enterprises can implement these practical measures in-house.

- Assessing Your Document Landscape: Begin with a comprehensive assessment of existing document processes. Identify inefficiencies and prioritize areas where AI-powered document processing can make the most significant impact.

- Building A Data Team: Form a team of experts in data science, machine learning and document processing. If these skills still need to be improved, consider hiring or training to build the necessary capabilities.

- Cleansing And Normalizing Data: Invest in data cleansing and normalization for accurate extraction and processing. Clean, standardized data is vital.

- Ensuring Vendor Reliability, Scalability And Flexibility: Choose a reliable AI-powered document processing service provider aligned with your organization's needs. The provider should help you scale up as your business grows to handle increased document volumes. At the same time, the service provider needs to be flexible, as their technology should be adaptable to the existing workflow at the enterprise.

- Engaging IT And Security Teams: Involve IT and security teams to manage integration complexities and ensure security and compliance standards.

- Collaborating With Finance And Procurement: Justify the AI-powered document processing investment by collaborating with finance and procurement teams. Develop cost-benefit analyses and negotiate favorable contracts with vendors.

- Implementing A Pilot And Managing Change: Test the document processing system with a pilot implementation. Gather user feedback. Address employee concerns through training and change management.

- Improving Continuously: Establish a post-implementation framework for monitoring and improvement. Regularly evaluate performance and gather insights for optimization.

By following these steps and addressing potential challenges, organizations can harness AI-powered document processing to streamline tasks, enhance B2B customer experiences and create a more delightful journey. Just as ordering pizza online is simple and satisfying, B2B interactions can become equally seamless, making customers happier and more loyal.

Latest Post

EASILY PROCESS COMPLEX TRADE FINANCE DOCUMENTS USING ARTIFICIAL INTELLIGENCE

December 26, 2022

IMPLEMENTING ROBOTIC PROCESS AUTOMATION FOR LONG-TERM SUCCESS

December 26, 2022

EASILY EXTRACT COMPLEX DATA FROM DOCUMENTS USING

December 26, 2022

THE RISE OF INTELLIGENT DOCUMENT PROCESSING

December 26, 2022

SureMatch

December 26, 2022

SureMatch

December 26, 2022

ARTIFICIAL INTELLIGENCE PLATFORMS WILL DRIVE THE NEXT PHASE OF TRADE FINANCE GROWTH

December 20, 2022