THE RISE OF INTELLIGENT DOCUMENT PROCESSING

Yes. There are many document management, document processing, and workflow solutions that are made for the insurance industry. Solutions currently in use mainly follow the rules-based approach. They try to take into account every variation in the documents to be processed. However, this rule-based approach does not comprehensively handle the insurance industry’s document processing needs in terms of compliance, accuracy, and human efficiency. While this approach has been useful in the past, it is not enough for the needs of the modern insurance industry because of the vast amounts of structured and unstructured data that have to be reviewed, matched, and understood contextually. The gradual shift from paper-based to electronic record-keeping is a key factor in using intelligent document processing systems as they feature easy maintenance, scalability, and integration, while at the same time ensuring increased compliance and efficiency through intelligent automation. In this context, the way forward is to adopt advanced solutions which are intelligent to extract and contextually interpret dynamic data from documents in different formats thereby reducing the overall processing time, increasing the ease of doing business, and increasing revenues.

Impactsure's approach

Based on our deep understanding of Intelligent Document Processing and the evolving needs of the insurance sector, in particular, Impactsure is prototyping solutions that will enable its clients to solve current and emerging challenges. We partner with organizations on a long-term basis so that we can deliver ongoing value as the volume of data and complexity of business keeps increasing.

SURE: SECURE UNIFIED RESPONSIVE ENGINE

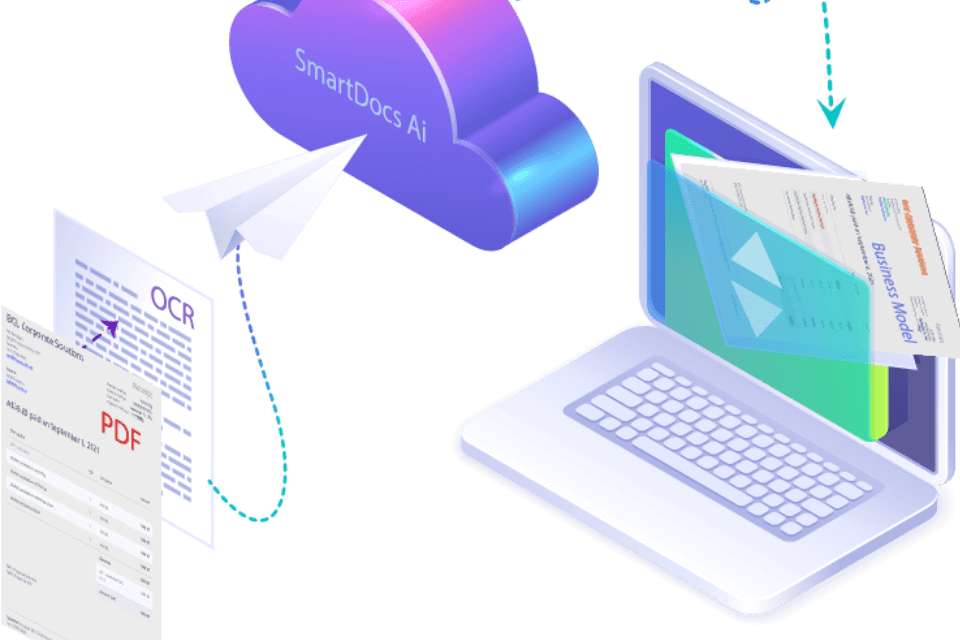

Impactsure has developed a solution called SURE (Secure Unified Responsive Engine) that extracts, processes, and intelligently interprets structured and unstructured data. It is a patent pending AI/ML +NLP tool that derives insights from structured and unstructured data in many formats. Depending on the use case, SURE can be adapted to intelligently automate various types of tasks that rely on manual intervention, require accuracy, and are subject to regulatory compliances. The key capabilities are:

- AI text extraction: Neural Network based Data Extraction for high performance and accuracy (for example- it can extract a 60-page scanned PDF file in less than a minute)

- Classification engine: Domain-based AI classification system that can be pre-trained for multiple document types within a docket or set of documents

- Document index: Identify, index & highlight specific document type

- Key value extraction: The AI can be trained to identify important data within specific documents

- Exception rule engine: Configurable rules to identify and alert users

- Supervised AI learning: Feedback loop with Continuous AI learning with an in-built repository and user input

- Flexible UI: Easy-to-use interface with the option available to integrate within existing applications

- API Integration: API integration for workflow engine (data + files), master data, user management

- Flexible deployment: Available as an on-premise or cloud-based solution

SUREMATCH

SureMatch is built on the SURE platform. It enables human operators to process complex documents easily by intelligently automating document-based processes that rely on manual human effort. The key areas of research and development currently being undertaken to adapt SureMatch specifically for the insurance sector are-

- Using advanced NLP (Natural Language Processing) to understand clauses, commonalities and mismatches, discrepancies, and exceptions for insurance purposes

- Using advanced NLP (Natural Language Processing) to understand information like diseases, disabilities, hospitalization, and other parameters

- Combining OCR technologies with AI/ML to digitize manual entry of applications

- Assisted decision-making for human operators to decide on claim approval, rejection, or seek additional information

Document processing and claims scrutiny :

SureMatch is a specialized solution geared towards automating the portions of document matching and claims scrutiny. Normally, it is seen that claims processing is a time-consuming activity where the human agent has to manually scrutinize the claim against many supporting documents and against the prescribed guidelines. This is an intense, time-consuming error-prone activity- which if not performed accurately will result in wrong settlements and customer dissatisfaction.

Training and skill enhancement for claims processing :

Moreover, training and keeping the claims processing workforce updated with the latest changes are expensive. Insurers are facing talent shortages as skilled employees retire and attracting new employees becomes a struggle. They are responding by using automation for low-skill activities and modifying their traditional talent requirements to build a workforce for the digital age. Companies have to ensure that employees do not become highly influential in certain roles such that business activity becomes person dependent. Our solution will also help staff learn the process much faster while staying compliant with the requirements.

Compliance

Insurance is regulated and insurance providers have to comply with strict regulations. We aim to solve the complexity of processing claims while improving accuracy and reducing compliance-related issues, while at the same time keeping the operational costs of doing business under control.

SUMMARY

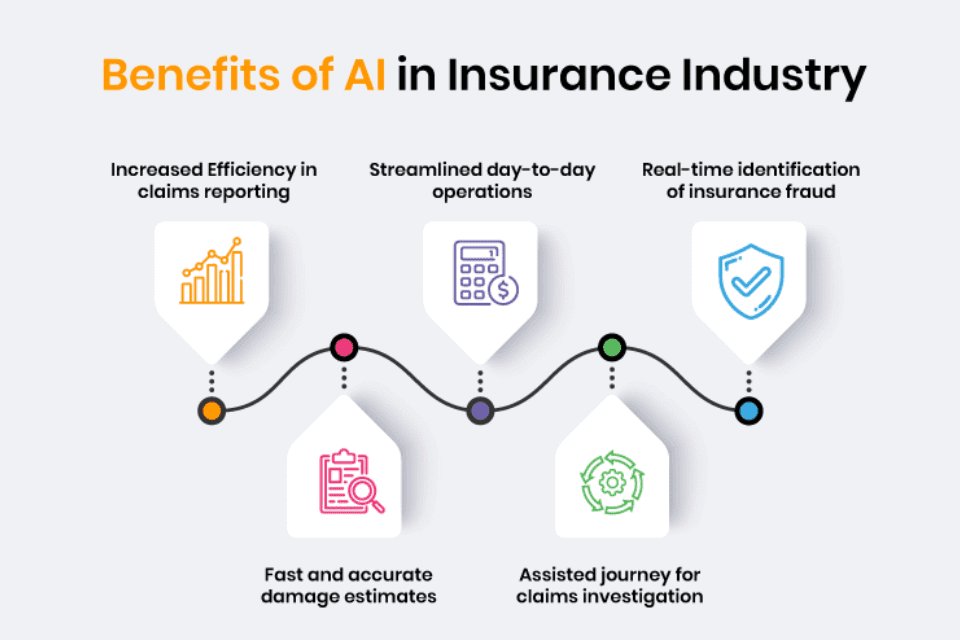

The growing volume, variety, velocity, and value of data cannot be ignored. Insurance companies that invest in technologies and tools that intelligently automate document processing will save money by reducing operational and compliance costs. AI is best used to augment the capabilities of humans and not replace them. A well-trained AI solution will drive consistent, auditable, and accurate decisions and help insurance companies bring in higher operational efficiencies into their business, while at the same time increasing revenues and profitability.

Impactsure helps people Interpret Information. Intelligently, Insightfully. Our products and solutions help people manage volumes of ever-growing documents and data and enable them to continuously adopt efficient ways to work with a focus on taking decisions with confidence while ensuring higher levels of accuracy and reliability.

Latest Post

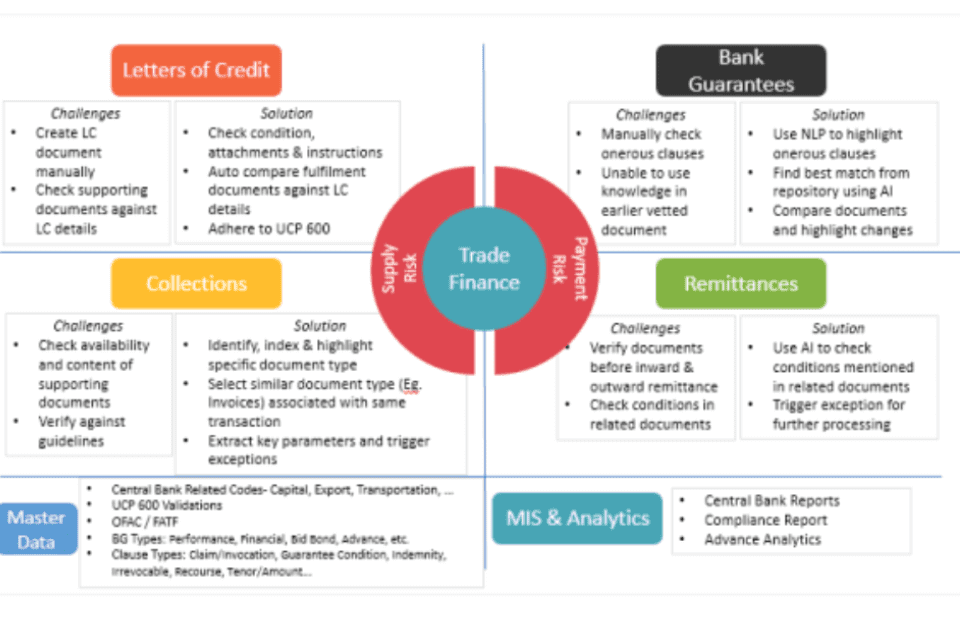

EASILY PROCESS COMPLEX TRADE FINANCE DOCUMENTS USING ARTIFICIAL INTELLIGENCE

December 26, 2022

IMPLEMENTING ROBOTIC PROCESS AUTOMATION FOR LONG-TERM SUCCESS

December 26, 2022

EASILY EXTRACT COMPLEX DATA FROM DOCUMENTS USING

December 26, 2022

SureMatch

December 26, 2022

SureMatch

December 26, 2022

ARTIFICIAL INTELLIGENCE PLATFORMS WILL DRIVE THE NEXT PHASE OF TRADE FINANCE GROWTH

December 20, 2022

MULTILINGUAL AI: BRIDGING THE LANGUAGE GAP IN DOCUMENT PROCESSING

December 15, 2023